How much would I need to invest to live of a dividends?

How much would I need to invest to live of a dividends?

Living off of dividends sounds both, highly exciting as well as painstakingly complicated. It is quite a daunting task to find a stock where you can earn consistent dividend income and also earn handsome returns as the stock appreciates.

Moreover, a million dollar question our experts at Dividend Watch are frequently asked is how much should one needs to invest in order to receive enough dividend pay.

Keeping in mind all the above situations, in this article we have attempted to provide you a clear overview about how dividends work and what should be the capital which you need to invest.

How dividends work

Dividends, in simple terms, is the proportion of company earnings which a shareholder is entitled to as a reward for staying invested for a long time.

Lot of companies pay quarterly dividends, monthly dividends & even yearly dividends and the amount of dividend one receives is at the discretion of the company which may or may not change each year.

Hence, it becomes essential to stay updated with corporate announcements as well as Quarterly & Annual results to ensure your capital is parked at the right place.

To make your investing journey more rewarding and convenient, we at Dividend.Watch have designed Dividend Calculator which is a powerful tool to help you decode every aspect of a stock and get an estimate of the future dividend income you can expect in a matter of seconds.

Investing for Dividend Income

Investment is a subjective matter as every individual’s capital allocation, earning desire, risk appetite as well as horizon differs. Therefore, we have touched few pointers to keep in mind before taking the plunge.

Understanding your Needs

Clarity is power in itself, therefore the best way to know how much you need to invest is by being clear on your monthly expenses & the key here is to be brutally honest to yourself.

We can absolutely help you get an estimate but would that amount be enough or you should gradually increase investments through a Reinvestment Strategy.

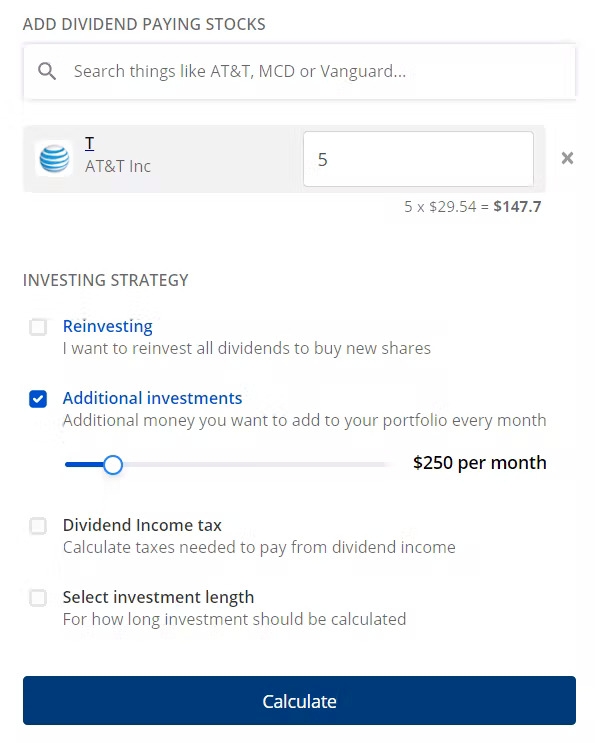

Our Dividend Calculator with its Additional Investments feature will enable you to get an estimate which is based on the stocks or ETFs historical performance as well as its dividend payouts.

Analysing the Investment

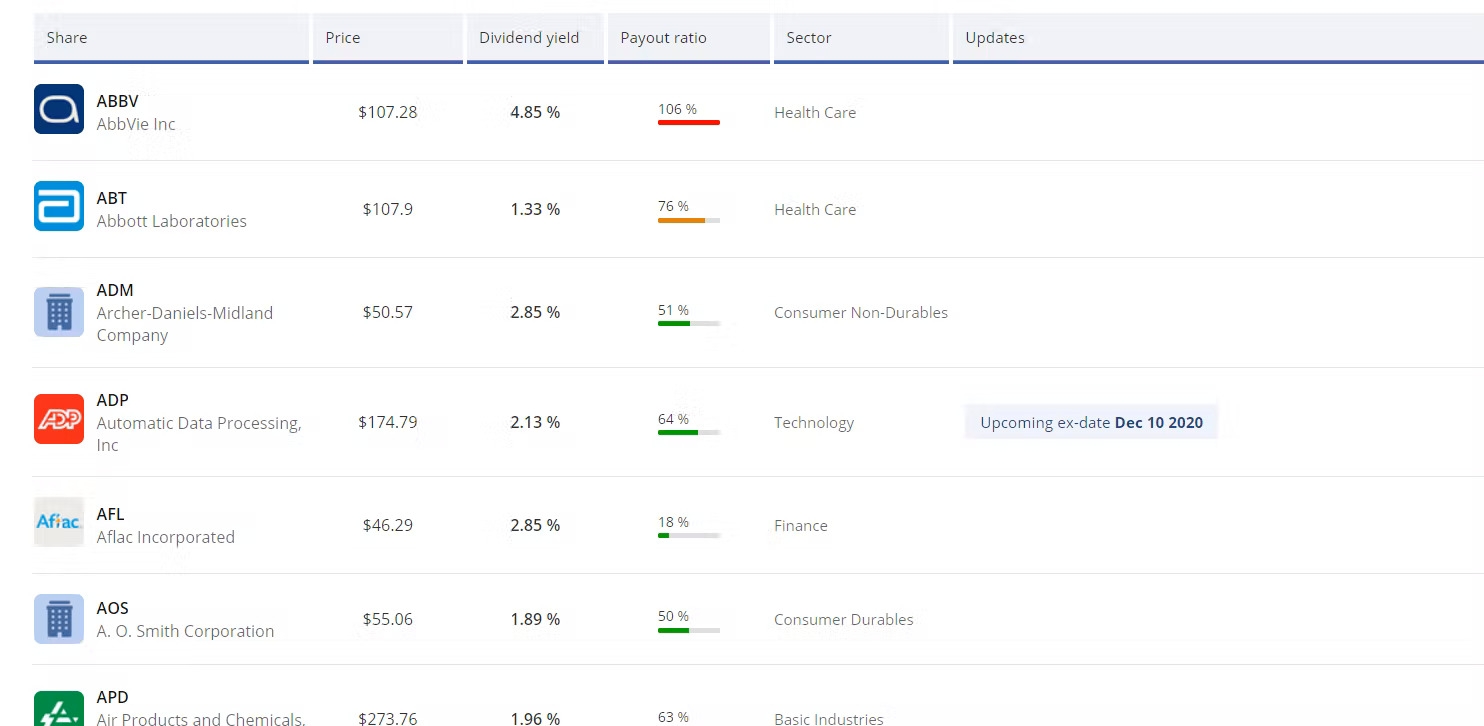

It is important to note that dividend income is a great source of passive income, however it is essential to do an in-depth research when choosing the investment instrument.

It is obviously cumbersome to understand the financial analogies & for the same reason we have developed Dividend Calculator based on advanced mathematical models designed to provide you with accurate dividend calculations in just few clicks.

Tax Management

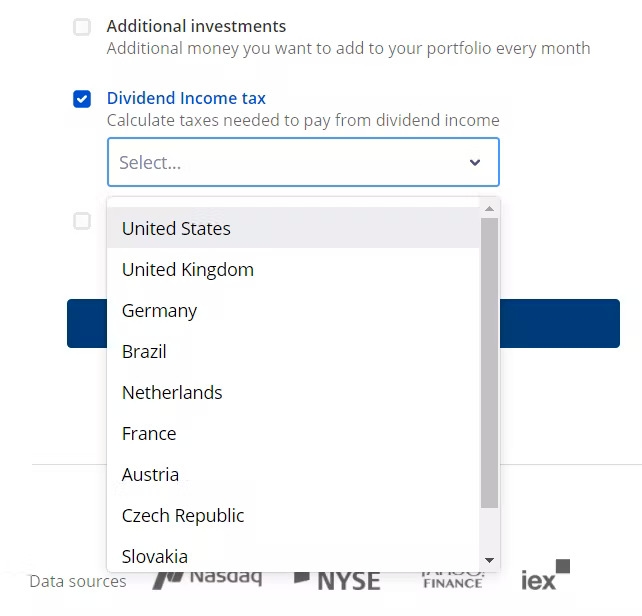

Last but definitely not the least is to understand the taxation on your dividend earnings. As per the LTCG Tax or Long Term Capital Gain Tax, any income which you earn through financial markets is taxable.

Therefore it is good to calculate before hand the taxes you would need to pay from your dividend income. With the feature of Dividend Income tax, Dividend Calculator can prove to be a helping hand here as well, as it will provide you clarity on the taxes needed to pay & will make tax management much simpler.

As you can make out from the points above that our Dividend Calculator is a powerful calculator which combines mathematical formulas and stock history context to simulate a dividend portfolio for many years ahead.

Try it today and make your journey to achieve financial freedom much more simple & convenient.