4 Reasons to Track Your Income

Dividend investing is great way to get passive income. With each stock purchase, you are building your passive income. At the beginning, you get just a few dollars, but this will evolve into something big after some time.

And remember, while this income is passive, there are many reasons to track it actively.

#1 To see your goals

As an investor, you should start with setting up your goals. Without goals, there´s no investment strategy, so this is essential to start with. The goal can be very simply stated:

"I want to have $ to cover my monthly expenses."

"I want to retire in X years.”

You can use our FREE dividend calculator to calculate what you need to achieve your goals.

If you see that your goal is too far away, don´t worry. Investing is a long-term process where endurance is the key ability.

To make the journey easier, you can start with short-term milestones, such as, "How long it will take me to get $100 a month," or maybe just start with how long it will take you to get free pizza every month.

#2 To know how much you’ve improved over time

As employees, we´re always measured against our personal targets or company goals. There are many performance reviews during the year, and the most resonating question is, how did you improve?

With proper dividend tracking, you´ll see your improvement immediately with every new purchase or dividend growth declaration, and you will know how it boosted your passive income.

And there is no better message you can get than being paid more. Employees are happy every salary raise, but they get this feeling only a few times a year. With dividend investing, you can get your raise many times a year, and seeing it visually in your tracker is much more appealing.

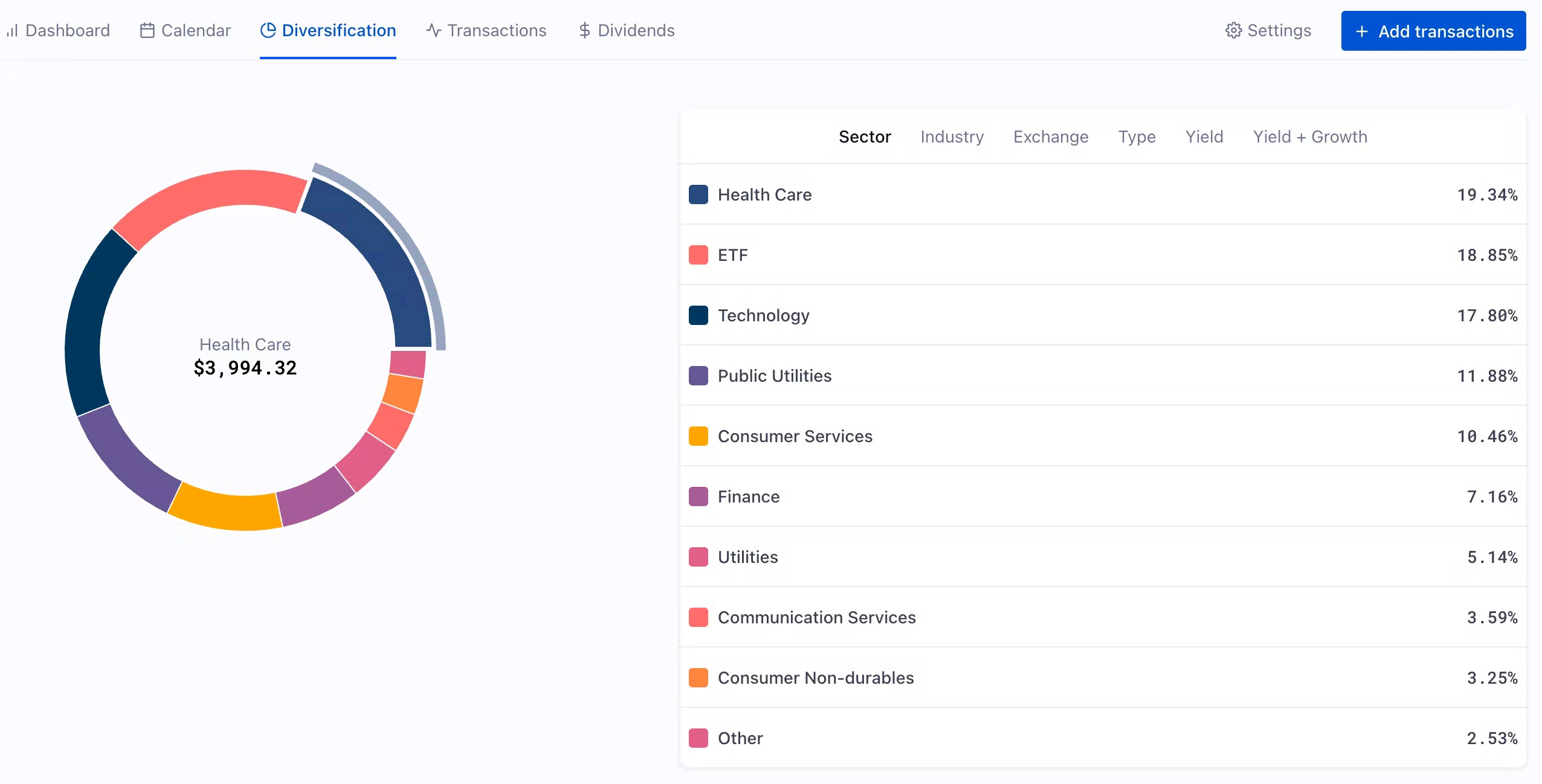

#3 To properly diversify

Diversification is also important. There are 11 main segments in the markets, thousands of companies and many countries you can be invested in.

The more sources of income you have, the better. At the same time, you need to keep certain rules such as not being overweight in one segment or balancing your exchange rate risk.

Again, these rules are individual. Some investors can live with just a few stocks, and others just like stock picking and are more comfortable with broader diversification. This is why we putting so much emphasis on diversification dashboard in our own dividend portfolio tracker.

#4 Because it is YOUR income

Imagine how much time you spend as an employee on projects to deliver higher revenue or profit. These goals are important and emphasized to all employees as a mantra for them.

And now think about how much time you spend building and tracking your own personal wealth…

It´s time to change that.