Portfolio tracker updates

Portfolio tracker transaction improvements

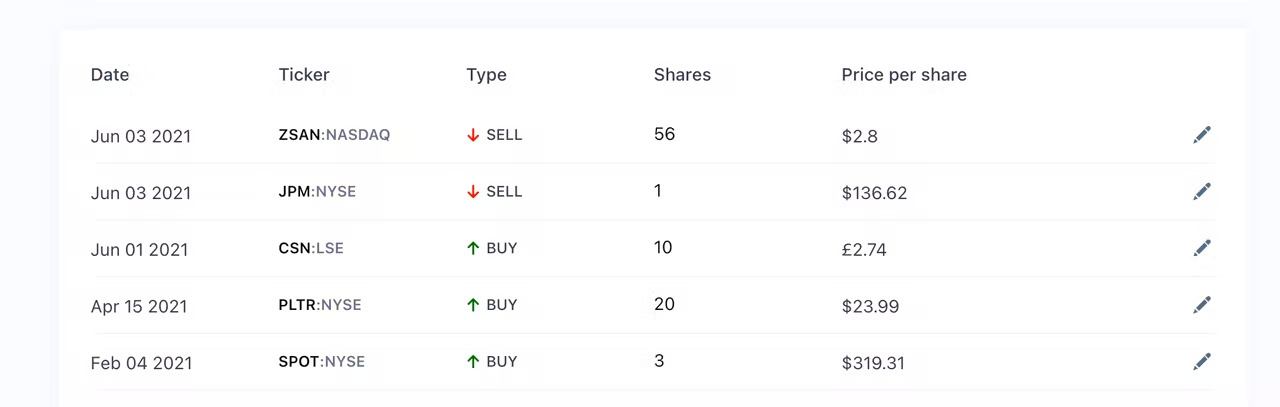

Transactions management is sometimes a hard job to do but it is a very important one. This is the reason we continue thinking about how to make it better. Last month we introduced .CSV import and now we redesigned the portfolio transaction view. This handy view shows all portfolio transactions. You can also filter transactions to show only transactions of a specific stock. Besides the new polished design, you can now edit your current transactions.

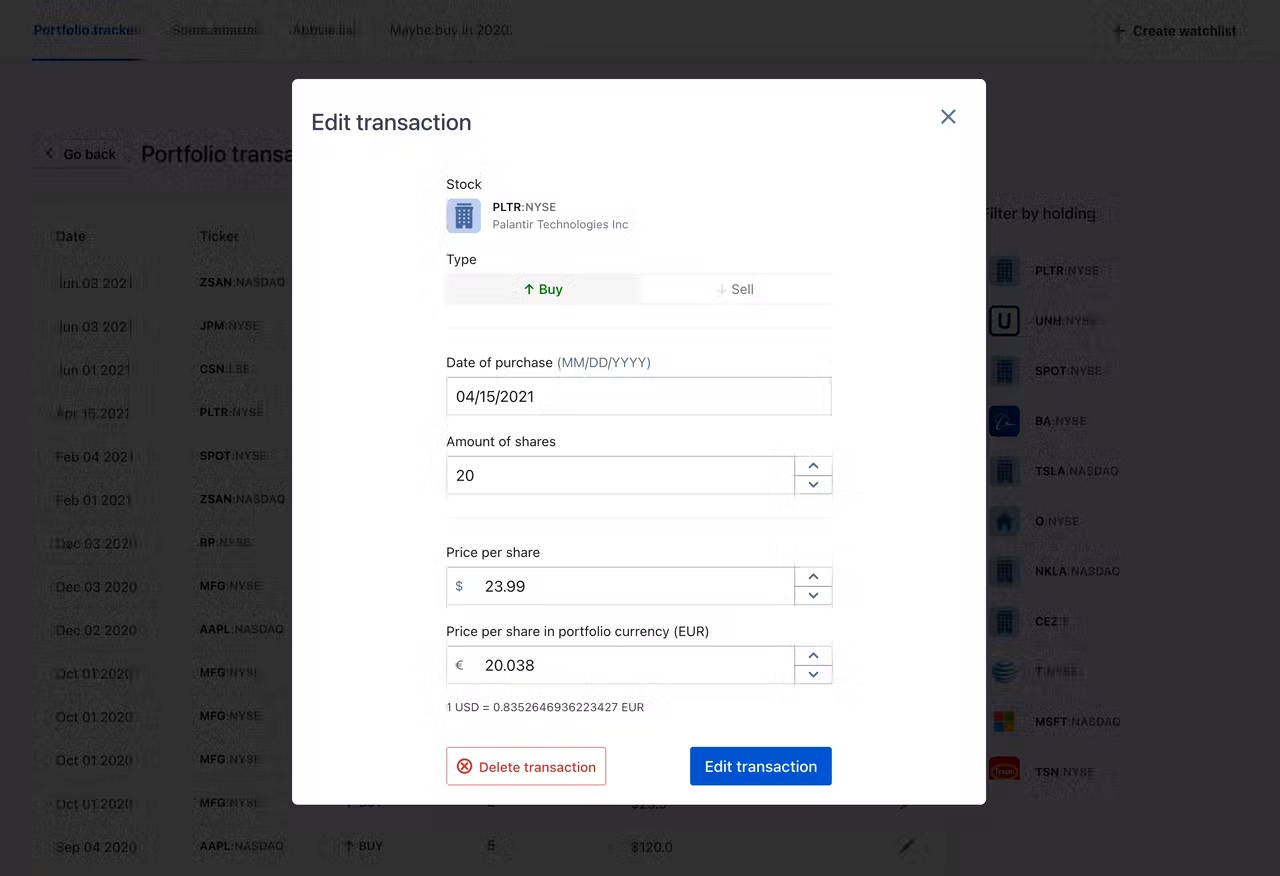

Portfolio multi-currency support

So far portfolio currency settings was only for viewing your portfolio in the selected currency. We took another step and released full multi-currency support. Each transaction containing stock that isn’t in your portfolio currency will also have a secondary price field named “Price in your portfolio currency”. When you set this, it will automatically calculate FX rate and calculate currency gain or loss of specific holding (more of that below)

If you have a lot of transactions in currencies different from your portfolio's don’t worry. You don’t have to fill it all right now. If “Price in your portfolio currency” is not set, we will automatically take the closing FX rate from the date of transaction and use it for calculations.

Portfolio holding detail and calculating total return

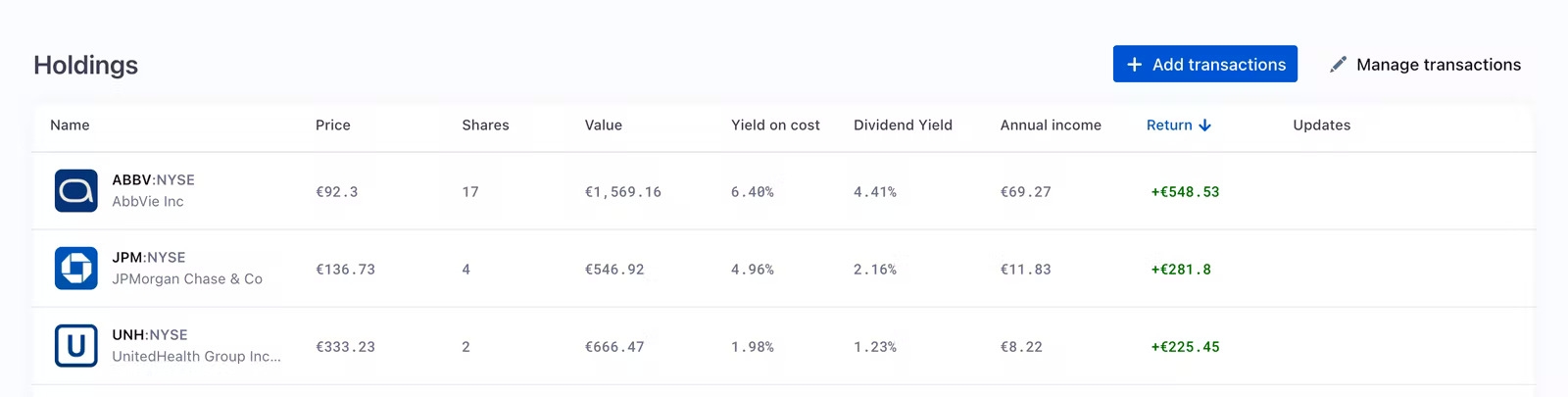

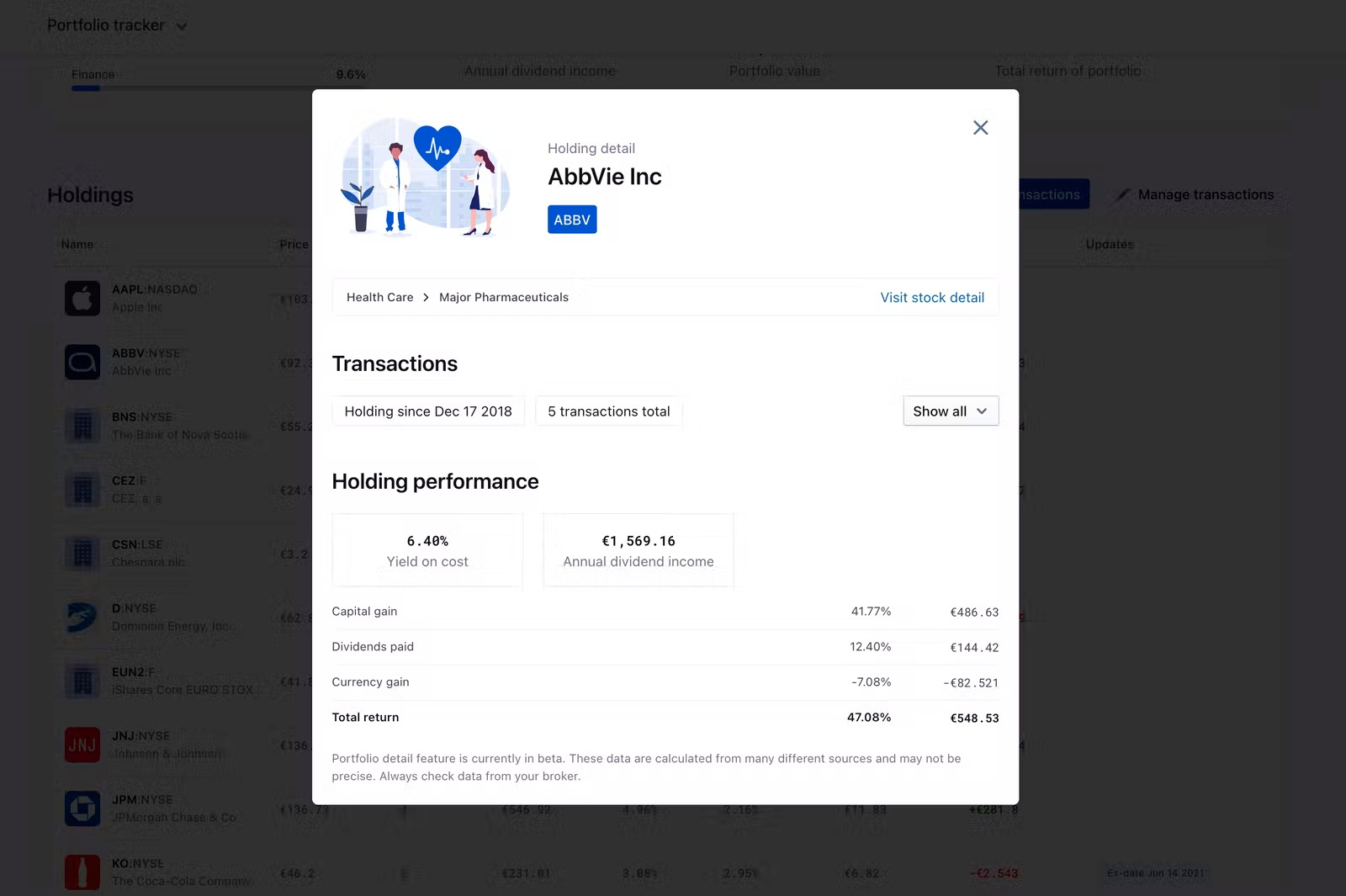

In the portfolio tracker we added a new column to the Holding table named “Return”. This number represents the total return of a specific holding. Total return is the sum of Capital gain + dividends paid + currency gain.

Your stock portfolio is not one piece of investment but it is a sum-up of a lot of different investments. To reflect this we are introducing portfolio holding detail. In this view, you will see the most important information about your holding.

This detail contains information about performance, there are three metrics when comes to holding's return:

Capital gain – most simple metric which simply tells difference between the buying price and current price.

Dividends paid – if you’re receiving dividends from your holding we calculate the sum of all dividend which were paid over time you’re holding the stock

Currency gain – Difference between currencies value (applicable only if you’re buying stock in a different currency than your portfolio's)

We are also highlighting two calculation for holding:

Yield on cost – which shows the real yield of a stock

Annual dividend income – shows dividend income for the last 12 trailing months

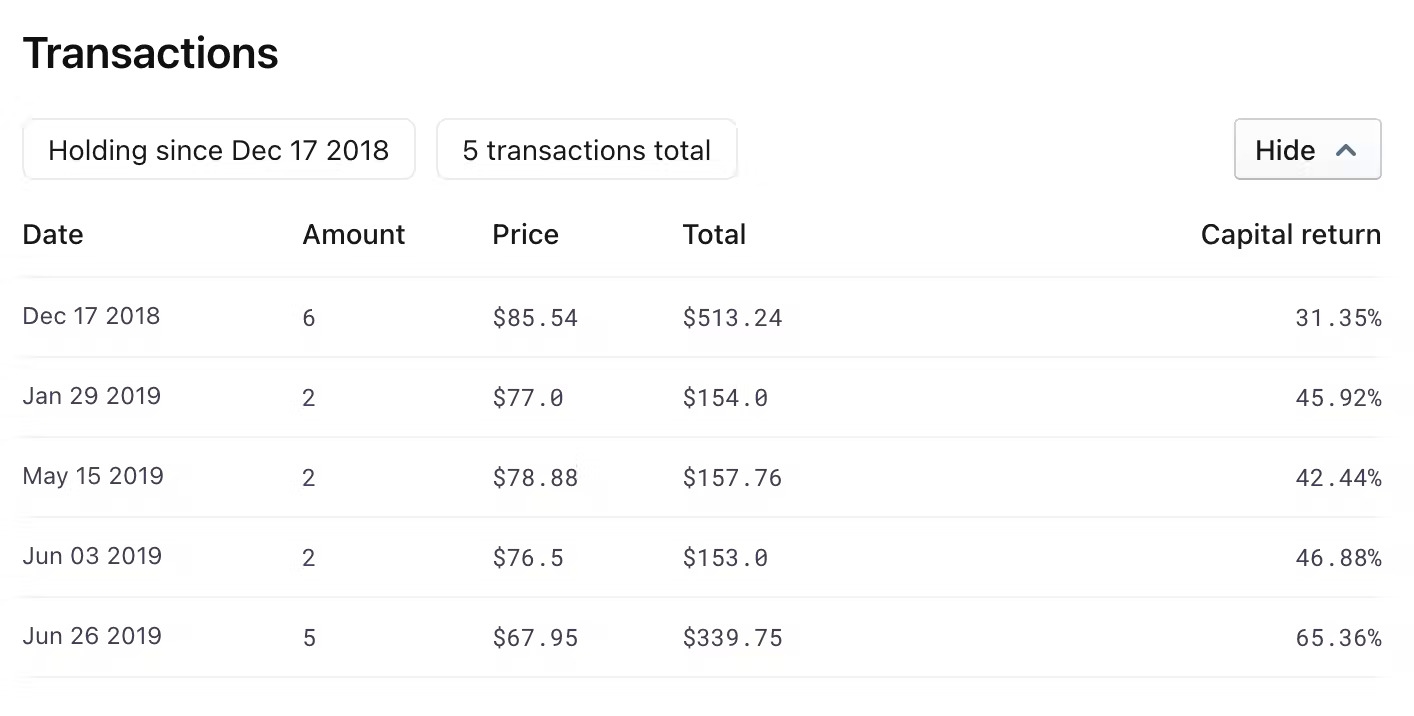

Dollar-cost averaging made easy in portfolio

One sweet cherry on the top in transaction view. Dollar-cost averaging is an important buying strategy where you buying stock over a longer period of time to the average total cost. This means that the capital return from each transaction is different. In portfolio holding detail you view all transactions within the holding and their capital return. These stats are re-calculated every 24 hours.