Johnson & Johnson Breakup: What to do

Specialization and focus are words that we hear more and more in recent years. Large conglomerates lack the necessary focus and decision-making speed as the world is changing so fast. Already this year there have been several interesting split announcements. Dividend investors were perhaps most interested (and maybe shocked) by AT&T split.

However, last week was unique as there were three big announcements – GE, Toshiba, and Johnson & Johnson. All of them are going to split up. With the respect to GE and Toshiba. Johnson & Johnson is the most popular of these three for a dividend investor. Let's have closer look at J&J split in this blog post and what I'm going to do with my shares.

Dividend king

Johnson & Johnson is a dividend king with an incredible 59-year dividend growth streak. It is the largest healthcare company in the world, with a more than 70% higher market capitalization than its closest competitor – Eli Lily. J&J revenue is ever three times higher than Eli Lily.

Apart from its size, J&J is also unique in that it has 3 different segments:

- Pharmaceuticals – focus on research and development of prescription drugs in areas such as immunology, infectious diseases, oncology and more

- Medical Devices - provides surgical, orthopedic, electrophysiological and vision care products such as disposable contact lenses

- Consumer Health - offers childcare products, Listerine mouthwash, sanitary pads and tampons (Stayfree, o.b.) or over-the-counter medicines (e.g. Zyrtec)

Most companies focus on only one of these segments. High diversification and stability were something that made J&J stand out.

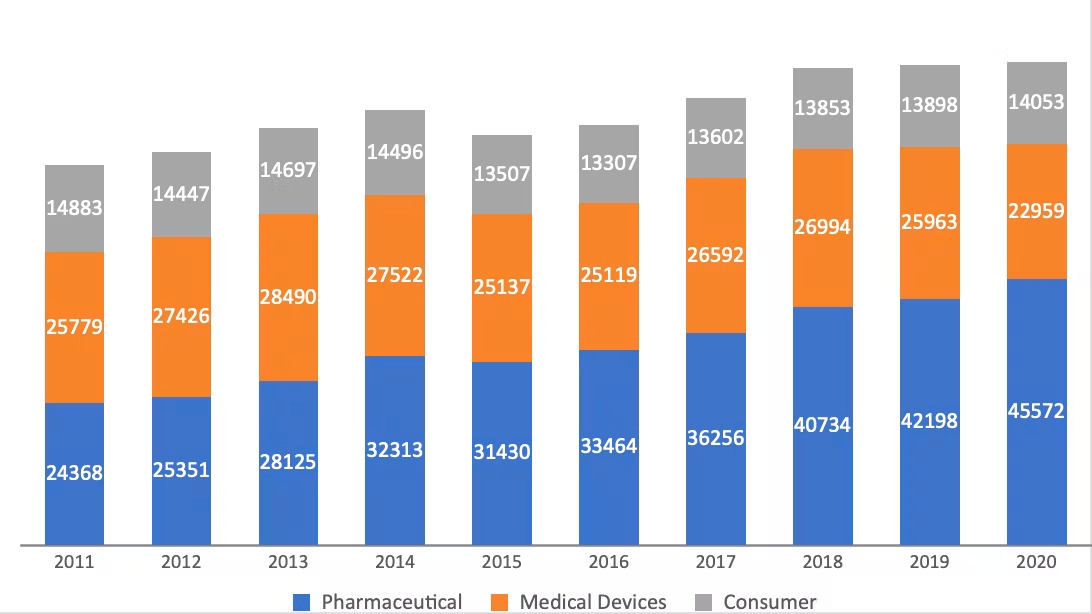

Looking at the long-term revenue development, we can see a clear thing – J&J's growth is driven by the Pharmaceuticals segment. The Medical Devices segment was significantly affected by pandemics and postponement of procedures. However, it is back in 2021 and growing +23% year-to-date.

Source: Author's research

Consumer Health has been stable for a long time. However, this segment caused many problems recently, especially due to the discovery of asbestos in talc powder. The company is facing thousands of lawsuits which expenditures have already reached billions of dollars. J&J is even preparing an interesting solution on how to separate those court costs from the company.

The company intends to separate these costs into a separate company, which should subsequently declare bankruptcy. If this goes well, it'll set an interesting precedent for how to deal with debt. 😊

This information is several weeks old, but the new split of the company which was announced on Friday is far more important than accounting tricks.

The breakup

The company announced that will spin-off the Consumer Health segment into a separate entity. Johnson & Johnson will continue to have 2 segments (Pharmaceutical and Medical Devices) and still be the largest healthcare powerhouse.

Revenue split will look like this:

- $77 Billion (84%) remains as the original J&J

- $15 Billion (16%) will be transferred into new company

Source: Johnson & Jonhson – investor relations

The name of the new company has not been announced yet. In any case, it will be a leader in many segments of consumer medicines. Separation is due to take place within the next 18-24 months.

The key message is that dividend should remain the same as these two companies will split the current payout as was confirmed in press release.

The official reason for the breakup is a better focus of management and investment allocation. The new consumer division requires a different approach and focus, given new trends like eCommerce.

“Our board and executive team have regularly evaluated Johnson & Johnson’s portfolio of business over the years, asking whether a broad-based approach best meets the needs of our stakeholders. And while this approach has historically served us well, addressing the complexity of today’s global healthcare and consumer environments now demands unprecedented innovation, focus and agility."

- Alex Gorsky, Johnson & Johnson CEO

Unofficially, it's obvious the consumer segment is the troublemaker with all the lawsuits and lack of growth.

It's fair to say that this is nothing new in this field. The healthcare segment is full of acquisitions and spin-offs. Currently, for example, GSK also works in the consumer segment separation.

This split is a bit reminiscent of Abbott's split in 2013, when it split the medical device segments (Abbott) and pharmacy (Abbvie). This may be the next step for J&J, but the company has denied any further split so far. Abbvie, which was considered a "rotten" division in 2013, has brought in a 250% increase in dividends since 2013. If J&J's consumer division had a similar performance, no one would be angry 😊

You can look at Abbvie analysis here or try our dividend calculator for FREE.

What I'm gonna do

Honestly, nothing special is going on. Both companies will be industry leaders, dividends should be kept, and there has been no fundamental change in Johnson & Johnson stock prices in the market either. It will be interesting how debt and dividends will split. By the way, remaining J&J divisions could cover the entire dividend by themselves. The above-mentioned example of Abbvie, shows that this type of spin-off can create value. There are also other different scenarios that could take place, like that a new company might be acquired (e.g. by Procter & Gamble).

As usual in these situations, I'm not going to do anything and will wait for more information. The consumer segment has very strong brands and is stable, so if management can resolve litigations and find the a way how to grow (revenue, earnings and mainly dividends), it might be good investment case.

I;ll give the new consumer company a try and see more after few quarters.

To see if Johnson & Johnson will fit your portfolio, let's try our dividend calculator for FREE.

We're tracking and analyzing over 35 000 stocks and ETFs.

You can Find great opportunities, calculate your perfect portfolio and keep track of your dividend stocks investments.

Disclaimer: I am long at JNJ. This article is only for educational purpose. Don't buy or sell stock based solely on above mentioned information. Investment in securities carries risks.