Investing with multiple brokers at once

Having multiple brokerage accounts is becoming standard. However, there are some issues with having multiple accounts. First, let’s dive into why even bother with multiple accounts with multiple stock brokers.

Better protection

Investing with multiple brokers can provide you with additional deposit insurance protection. Brokerage accounts in the United States, for example, are insured by the Securities Investor Protection Corporation (SIPC) up to $500,000, including a $250,000 limit for cash. By diversifying your investments across different brokers, you can effectively increase your insurance coverage, thus safeguarding your assets in the event of a broker's financial collapse.

Unique benefits

Each brokerage firm offers a unique set of benefits and features. Some brokers may provide access to exclusive investment opportunities, while others may specialize in particular asset classes or offer lower fees for certain transactions. Additionally, certain brokers may provide better research tools, educational resources, or superior customer service. By diversifying your investments across various brokers, you can take advantage of these distinct benefits, tailoring your investment strategy to capitalize on the strengths of each platform.

How to handle investing with multiple brokers

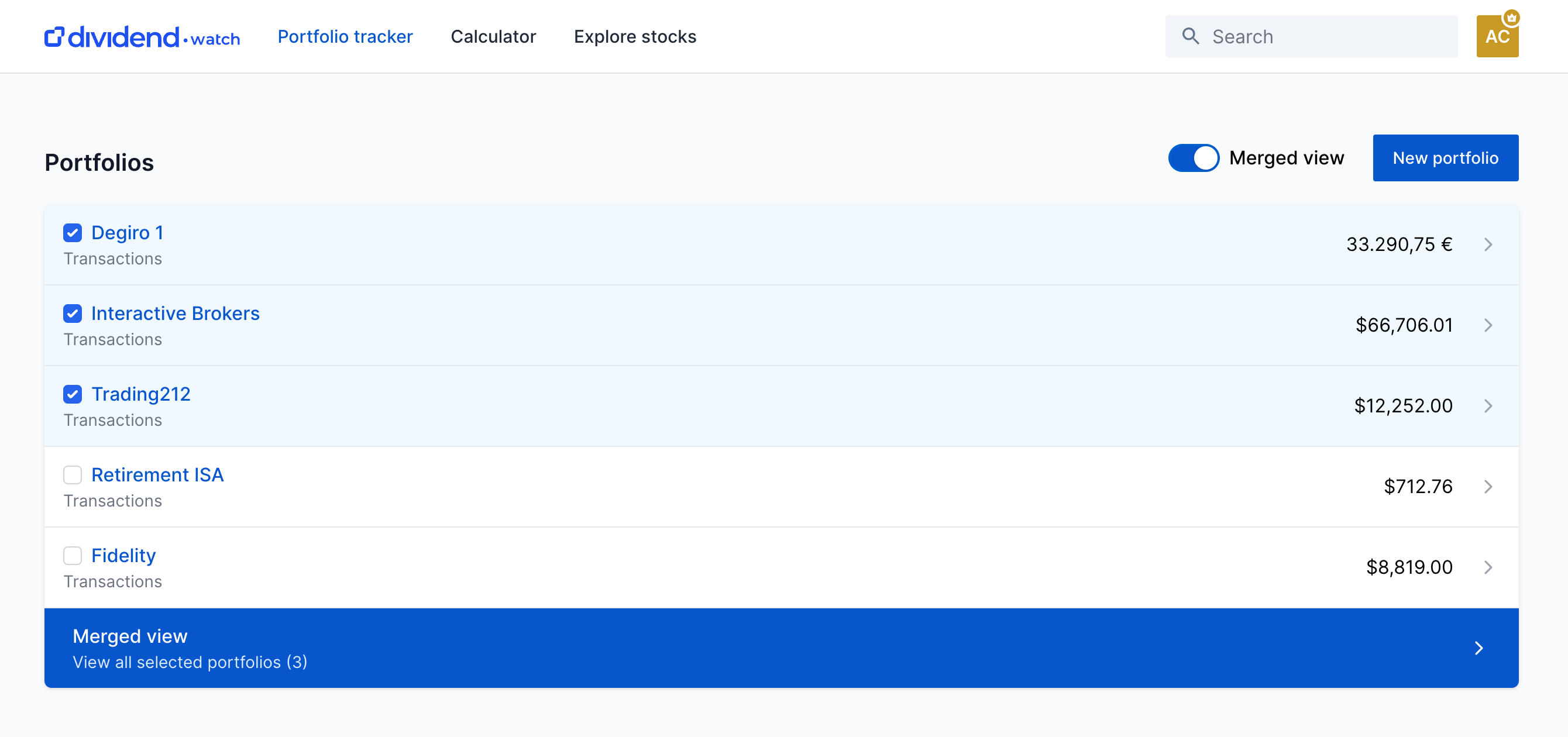

Managing multiple brokerage accounts can be complex and time-consuming. Analyzing your investment performance, tracking dividends, and maintaining a clear overview of your assets can be challenging when you have to juggle multiple accounts. This is where the dividend tracker from Dividend.watch comes into play.

Our dividend tracker allows you to seamlessly manage multiple portfolios in one place. This means you can easily track your investments across different brokers without having to switch between multiple platforms.

The platform also offers a merged view feature, which consolidates all your portfolios into one, enabling you to analyze your overall investment performance.