Dividend zombies: More stability in uncertain times

Volatility is not metric only for investors wanting to speculate on short-term price changes. It shows us how a company is perceived by the market and it can be a very interesting number for dividend investors, especially in times of great instability.

How we handle dividend stock volatility

We track company price volatility in comparison to the S&P500 index. Average volatility in the last 12 months gives us metrics commonly known as beta.

We go a little bit further than just a beta... Our algorithms analyze all dividend stocks every day and compare the results of every dividend stock against the average of other dividend stocks in the same sector. This is the most reliable volatility metric you can get when looking for stable dividend payers.

- Beta equals 1 = company stock has the same volatility as S&P500

- Beta is above 1 = stock price has higher volatility than S&P500

- Beta is under 1 = stock price has lower volatility than S&P500

Dividend zombies

We also track different stocklists and it’s hard to not notice that when comes to stability, one list is better than any other. Dividend zombies list tracking companies which are paying a regular dividend for more than 100 years. Today we picked three examples:

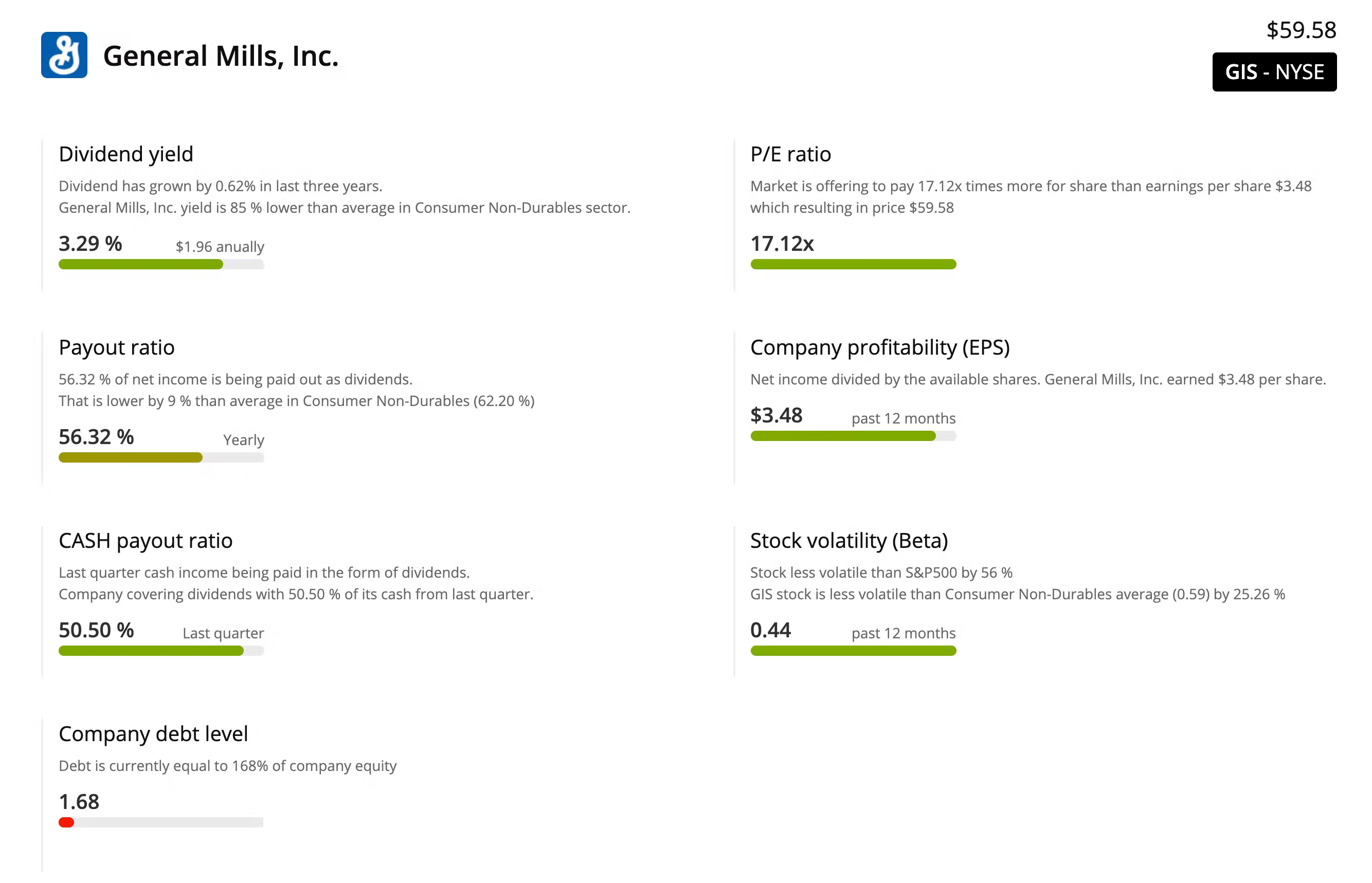

General Mills, Inc. (GIS)

Multinational manufacturer and distributor of consumer foods sold through retail. It owns over 100 food brands sold all over the world, it includes names like Cheerios, Annie's, and Häagen-Dazs. It pays dividends without interruption for over 120 years.

- 56 % more stable than S&P500

- See GIS stock detail page here

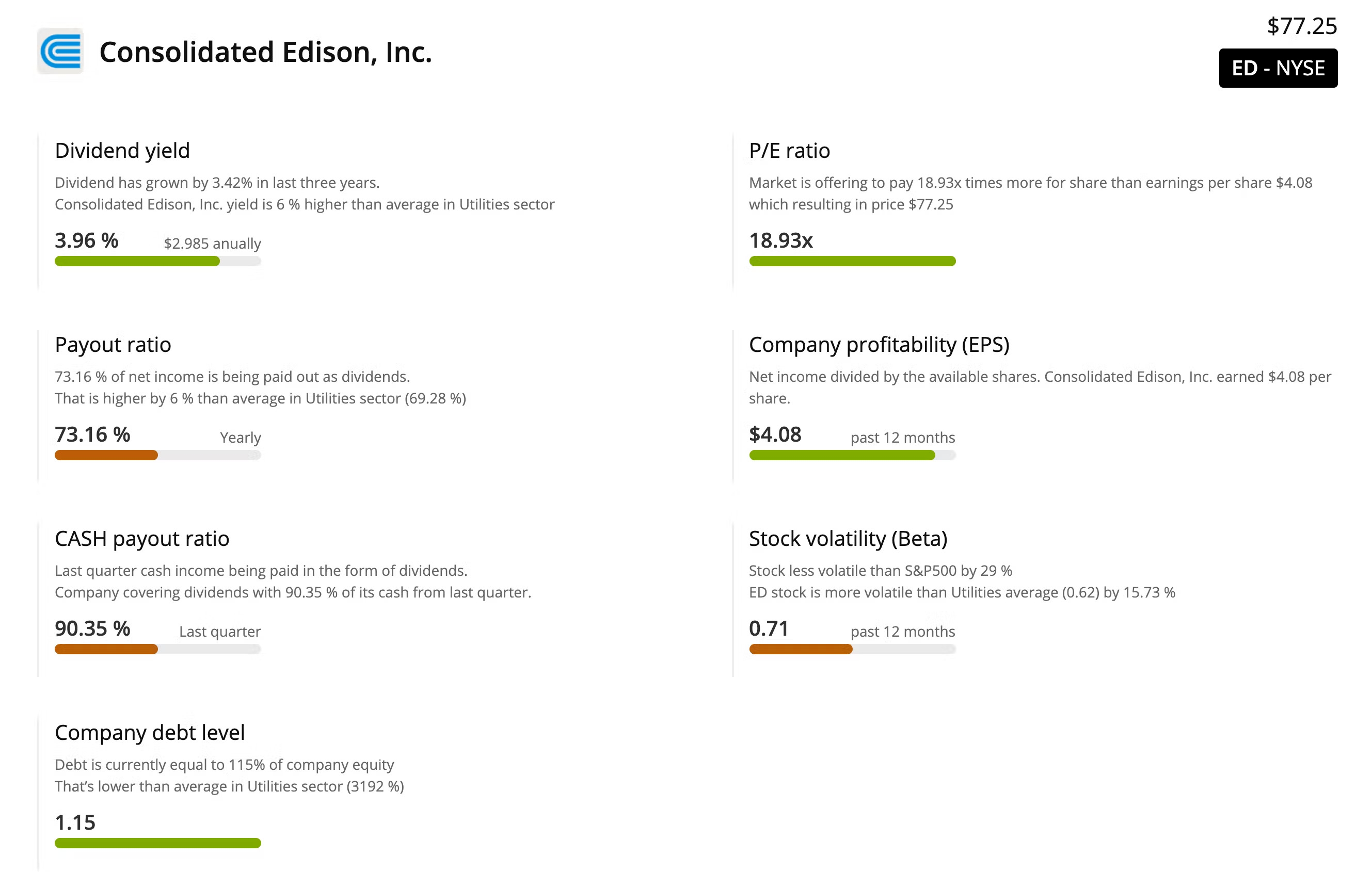

Consolidated Edison, Inc. (ED)

Company better known as Con Edison is one of the largest investor-owned energy companies in the US. About 70 % of revenues are from electricity which is distributed through many local subsidiaries. It was founded in 1823 and it pays dividends regularly from 1885.

- 29 % more stable than S&P500

- See ED stock detail page here

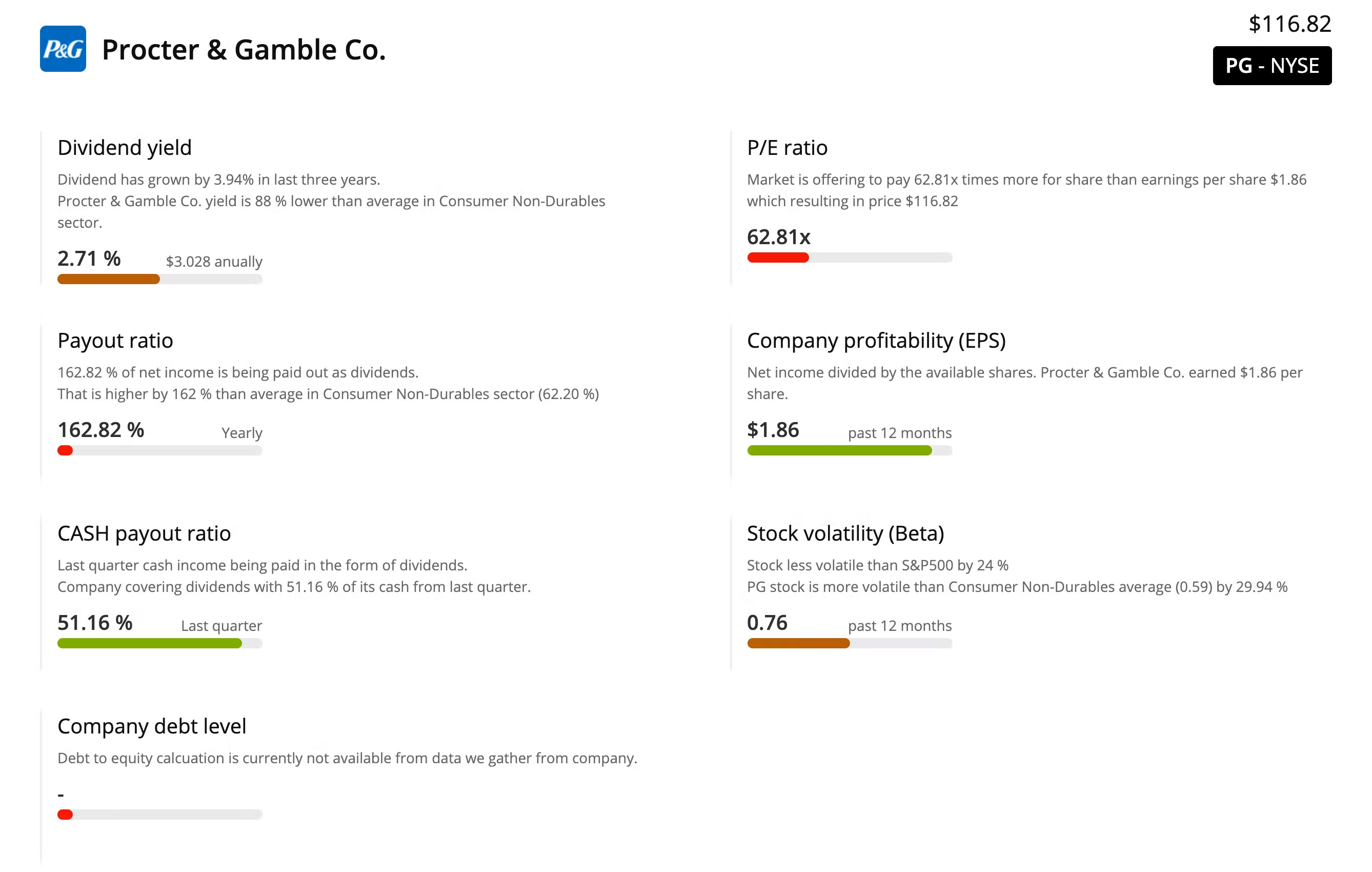

Procter & Gamble Co. (PG)

The company focuses on consumer goods. mainly on personal health/consumer health, and personal care and hygiene products. This corporation has operations in 80 countries and it pays regular dividends from 1891.

- 24 % more stable than S&P500

- See PG stock detail page here