Why you need dividend portfolio tracking

Why you need dividend portfolio tracking

The road for long-term investing success is… well... long, but it is not impossible. Like with everything, you need to have a goal, the right mindset and the right tools. If you are reading this, chances are you already have a goal. We cannot guarantee you have the right mindset—that is up to you, but we can give you the best tools possible. That why we created Dividend.watch in the first place.

Tracking is a key part of the success

Even when you can buy all the stocks in the world, the market is doing good and everything is fine, you still need to know what is happening with your portfolio. How are you doing in general? You need to constantly reinvent your approach to get the best results, which is why you need dividend portfolio tracking. You can use an app, information provided by your broker or an Excel spreadsheet. Any kind of tracking is still far better than no tracking.

What do you need to track?

Diversification

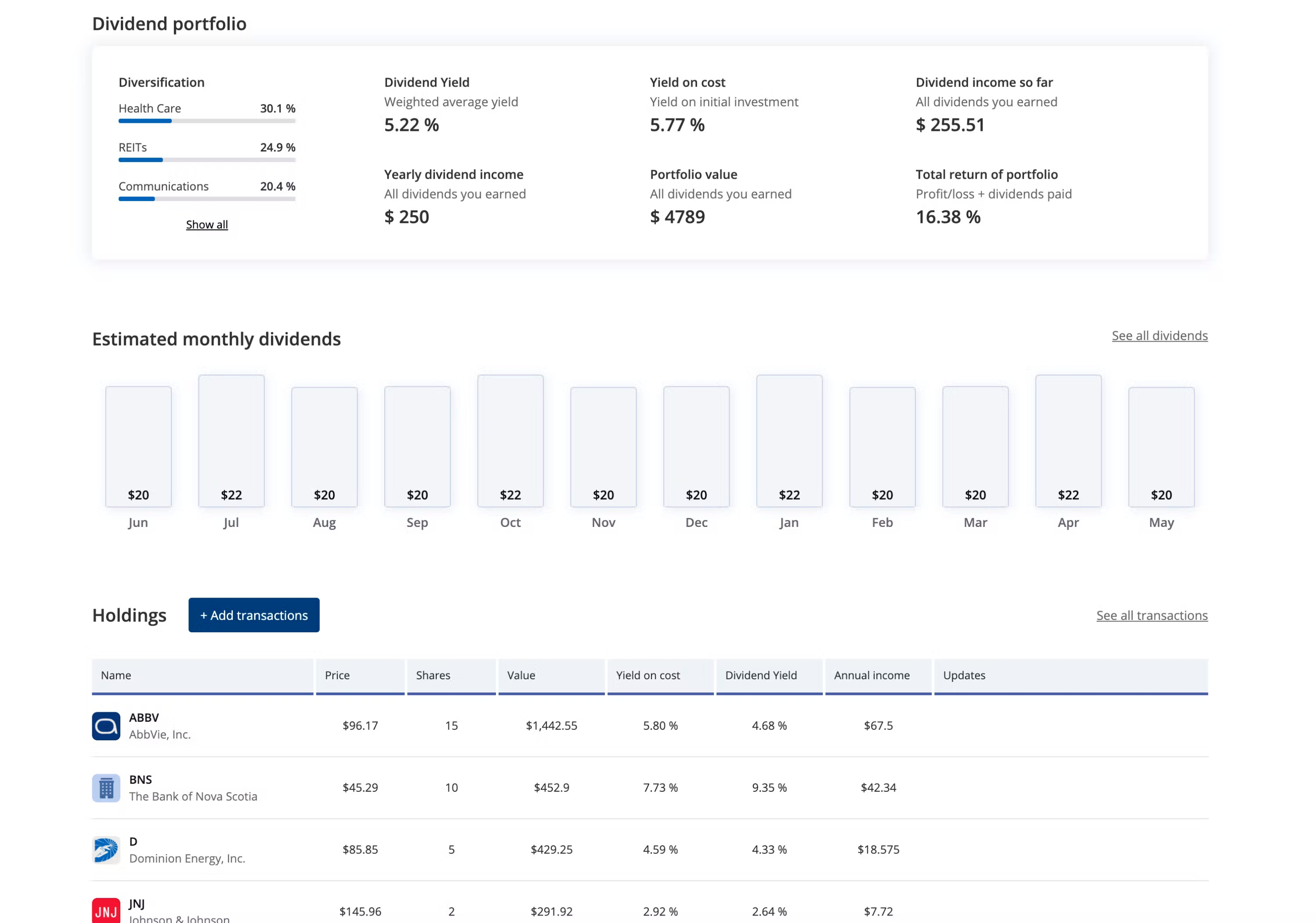

Safety first. Every dividend growth portfolio needs a solid diversification across sectors. You also shouldn’t pick just a few stocks; always try to find new opportunities. It is hard to say what an optimal number of stocks in a portfolio is, but rule of thumb is to have a minimum of 10 stocks across different sectors.

Dividend yield (not average!)

Many dividend investors make one mistake. They simply calculate the average yield of all shares they have and then use this number to represent the dividend yield of their portfolio. You need a weighted average yield, which counts with a number of shares and gives your precise dividend yield.

Yield on cost

The current dividend yield is a good thing to know. In the long run, it is not calculating the real yield of your investment. The yield on cost represents the real yield of your investment, so if you bought a stock during a dip, you would have a bigger yield than if you bought it for a current price.

Yearly income

This is the simplest but also the most-watched metric. What is the real amount of money you get from your dividend portfolio? It should always be calculated per year because different stocks have different frequencies of payouts - from 1 to 12 payouts per year.

Total return

The total return is not a key metric for dividend growth investors, but it is still worth knowing what a real return of your portfolio is, so you have a general overview of performance and know where you stand.

Dividend updates

You should have the possibility to see everything that is going on with your portfolio. Are there any dividend cuts? Is there a big price surge? Also, it is a great thing just to see your dividend come; we believe that it reinforces good financial habits and helps you to stay focused on the goal.

The bottom line of dividend portfolio tracking

You need tracking; otherwise, you are in the dark. You also need to track much more than just one or two numbers. You should look at your portfolio when you are considering a new stock purchase. Think of how this trade affects your portfolio, and if it gets you closer to your goal.

If this sounds good to you, try our dividend portfolio tracker! It calculates all important metrics, works great on both desktop and mobile, gives you important updates and is free to use up to 10 holdings.

If you would like to track a bigger portfolio, use other awesome features on our site and support us (we are an advertisement-free independent portal). You can try our premium membership, which is currently being offered for just $39 per year (so just $3.25 per month) and it comes with a 7-day free trial.