Dividend Cuts and Suspensions: How to Spot Red Flags and Protect Your Portfolio

One of the biggest risks that dividend investors face is the possibility of a company cutting or suspending its dividend payment. When this happens, it can have a significant impact on an investor's portfolio and income stream. In this article, we'll explore how investors can spot red flags that may indicate a company is at risk of cutting or suspending its dividend payment.

Understanding the Risks

Before we dive into how to spot red flags, it's important to understand why dividend cuts and suspensions happen in the first place. There are three main reasons why a company may choose to reduce or suspend its dividend payment, including:

- A decline in earnings: If a company's earnings are declining, it may no longer be able to afford to pay the same dividend amount to shareholders.

- A change in strategy: If a company is shifting its focus to growth initiatives or investing in new projects, it may choose to reduce its dividend payment to free up cash flow for these initiatives.

- Economic downturns: During times of economic uncertainty or recession, companies may choose to cut or suspend their dividend payments to conserve cash and strengthen their balance sheets.

Go for yield on cost all the time

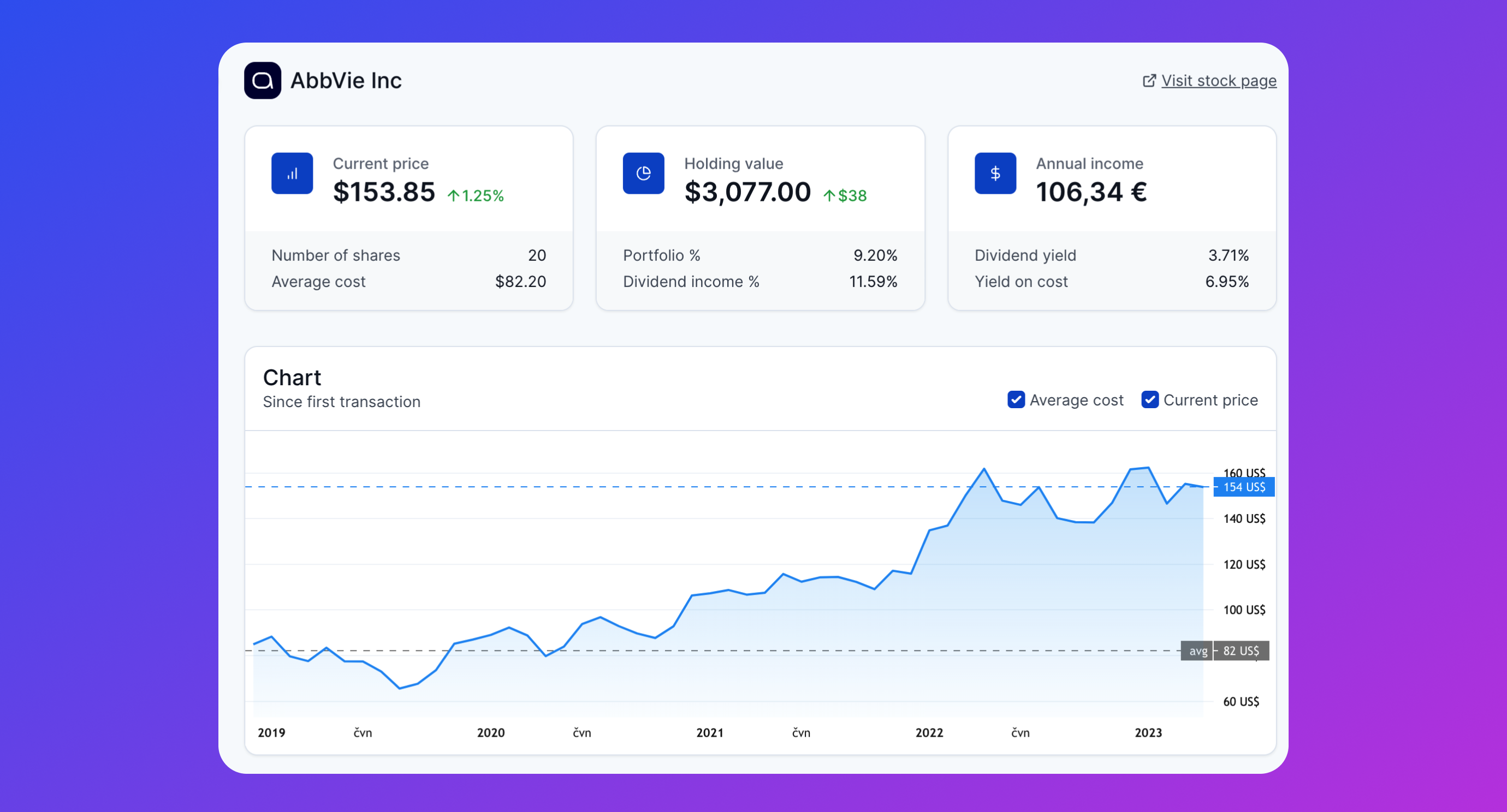

Yield on cost is a more comprehensive measure of a stock's dividend income potential as it takes into account the price at which the investor originally purchased the stock and dividend growth.

By tracking yield on cost through a portfolio tracker like dividend.watch, investors can optimize their portfolio for long-term income growth.

These tracking capabilities come hand in hand with dollar cost averaging, a proven investment strategy for minimizing risk and maximizing returns which can be also automatically tracked when using a transaction-type portfolio.

Spotting Red Flags

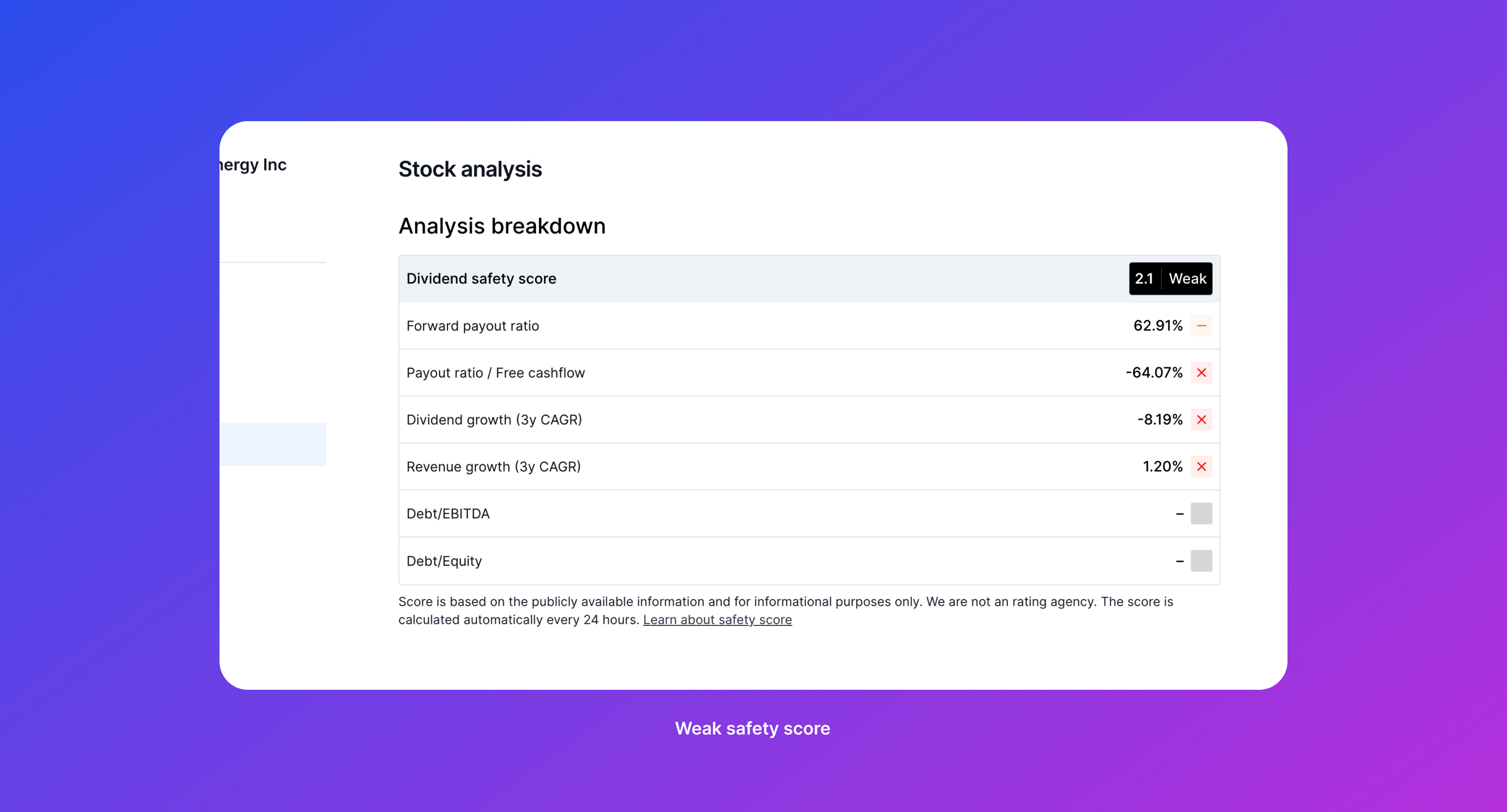

So, how can investors spot red flags that may indicate a company is at risk of cutting or suspending its dividend payment? Here are some key indicators to look out for:

- High payout ratios: If a company's payout ratio is too high, it may not have enough earnings to sustain its dividend payment.

- Declining earnings: If a company's earnings are declining, it may no longer be able to afford to pay the same dividend amount to shareholders.

- Weak cash flow: If a company is generating weak cash flow, it may not have the resources to sustain its dividend payment.

- High debt levels: Companies with high levels of debt may be at risk of cutting or suspending their dividend payment if they need to use cash to service their debt. This applies to some sectors more than others. For example in Utilities is common to see high debts.

Protecting Your Portfolio

Even with careful analysis, there's no guarantee that an investor will be able to avoid all dividend cuts and suspensions. However, there are steps that investors can take to protect their portfolio:

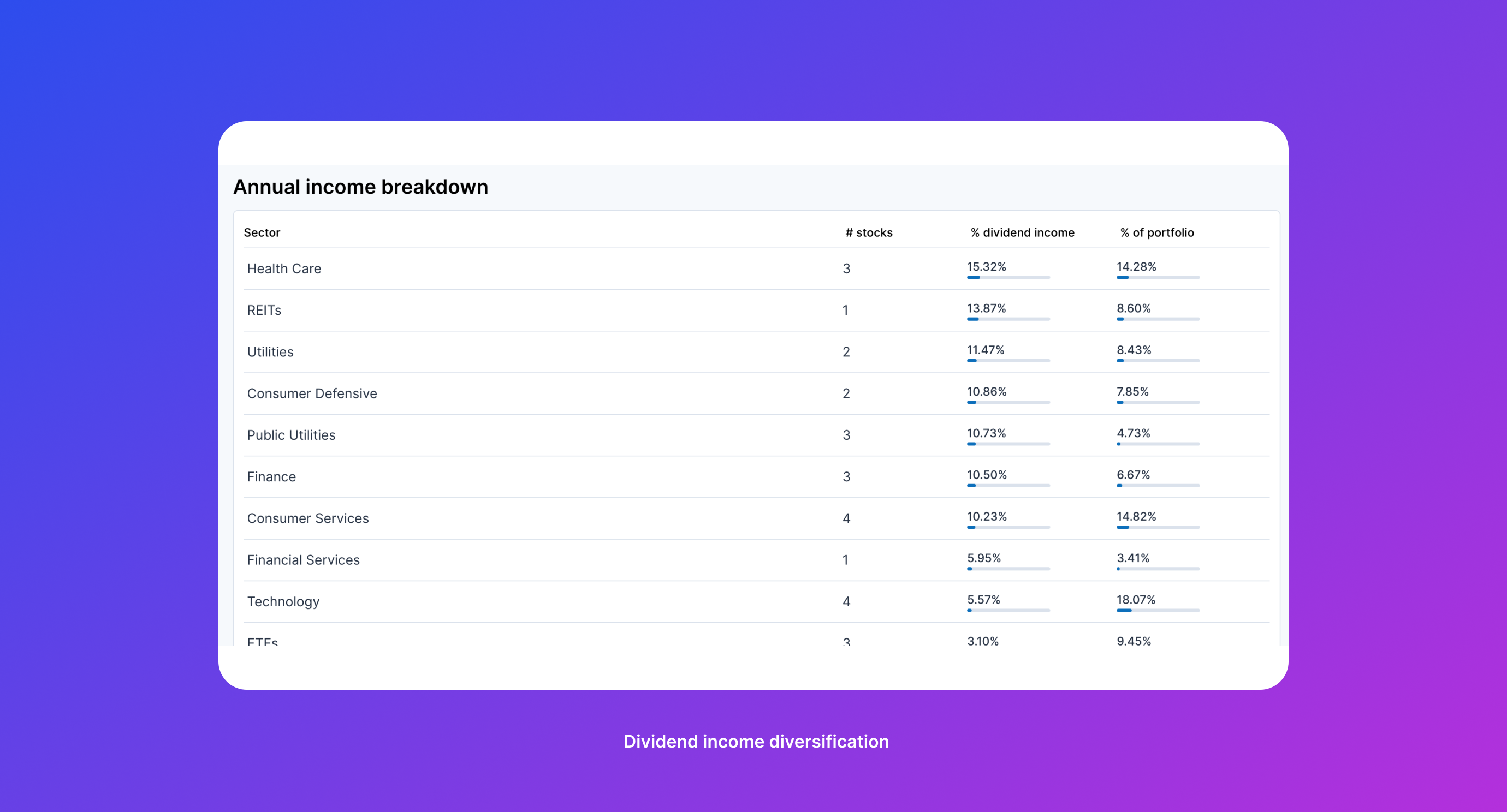

- Diversification: By investing in a diversified portfolio of dividend-paying stocks, investors can reduce their exposure to any one company and minimize the impact of any potential dividend cuts or suspensions.

- Regular monitoring: Investors should regularly monitor their portfolio holdings to stay up-to-date on any changes in a company's financial health or dividend policy.

- Setting realistic expectations: While dividend investing can be a great way to generate income, the high dividend yield in most cases also means high risk.

Dividend cuts and suspensions can be a painful experience. With the help of our portfolio tracker (which is a powerfull tool for dividend tracking), investors can stay on top of their holdings and make informed decisions that lead to long-term success.