Realty Income – the monthly dividend machine

Founded in 1969, Realty Income became one of the first real estate investment trusts (REIT). The company owns more than 7,000 properties in the U.S., UK, and Spain which lease to more than 650 commercial tenants in 60 industries. All lease agreements are under triple net lease so all operational costs such as maintenance, services, insurance, and taxes are managed by tenants.

Realty Income has been paying monthly dividends since its inception in 1969 and has been increasing its dividend every year since 1994 IPO. The company calls itself "The Monthly Dividend Company"

The monthly-paying dividend aristocrat with a yield over 4% is appealing for dividend investors and the company also outperformed all major indices!

Source: Realty income investor relations

Currently it has a streak of 96 consecutive quarterly dividend increases. The last one was very juicy with 4% growth over last quarter, 5.5% over last year!

And this wasn't the only value creation for the shareholders! Realty Income recently closes its largest acquisition ever – VEREIT and spin-off all office properties into a new company called Orion Office REIT (“ONL”). Shareholders of Realty Income received 1 share of ONL for every 10 shares of Realty Income they owned.

The company also bought its first properties in Spain (sale-leaseback from Carrefour) and boosted investment in the UK where its top tenants are retailers such as Sainsbury's, B&G or Tesco.

Realty Income expects that its fund from operations will grow by 5.5% in 2021 and 9% in 2022 as it expects SG&A savings and $5 billion investment into new properties. All is right on track to be in the top 5 largest REITs in the world soon.

Portfolio diversification

Diversification is constantly improving. One of the main challenges is that still more than 90% of the portfolio is allocated in the US. Nevertheless, even this doesn't sound that negative when you consider European acquisitions began only in 2019 and more importantly the general length of contracts in this field.

As stated above, current activities in Europe involve the UK and Spain, future expansion is expected. Another extreme can be seen in depending on retail (83% of revenue), some tenants are under pressure from e-commerce growth and this trend is expected to continue and grow.

As far as industrial diversification is concerned, the most crucial sector are convenience stores (11.6% of the portfolio at the end of Q3 21), dollar stores (7.5%), and drug stores (7.2%). Other sectors representing more than 5 % are health & fitness, restaurants with quick service, theaters, and home improvement. There are tens of other fields, in which Realty Income tenants are active, which makes sector diversification on a great level.

Source: Realty income investor relations

Risks

Apart from the necessity to increase diversification both regionally and business-wise, main challenges relate to REIT itself. Naturally recently driven by pandemic effects - some segments such as fitness centers (5%) or theaters (5%) where many tenants had their rent deferred.

Realty Income also facing a decline of some important KPIs - an average length of contracts falling from 15 years to 13 years, cap rate from 8% to 6%. On top of that, only 50% of tenants have investment-grade and with a potential interest rate increase, it is more difficult for REIT to invest in new projects.

VEREIT acquisition and Orion Office REIT spin-off

VEREIT acquisition further helps to diversify tenants and industries. Realty Income also expects to create value via costs synergies and acceleration of investment activities.

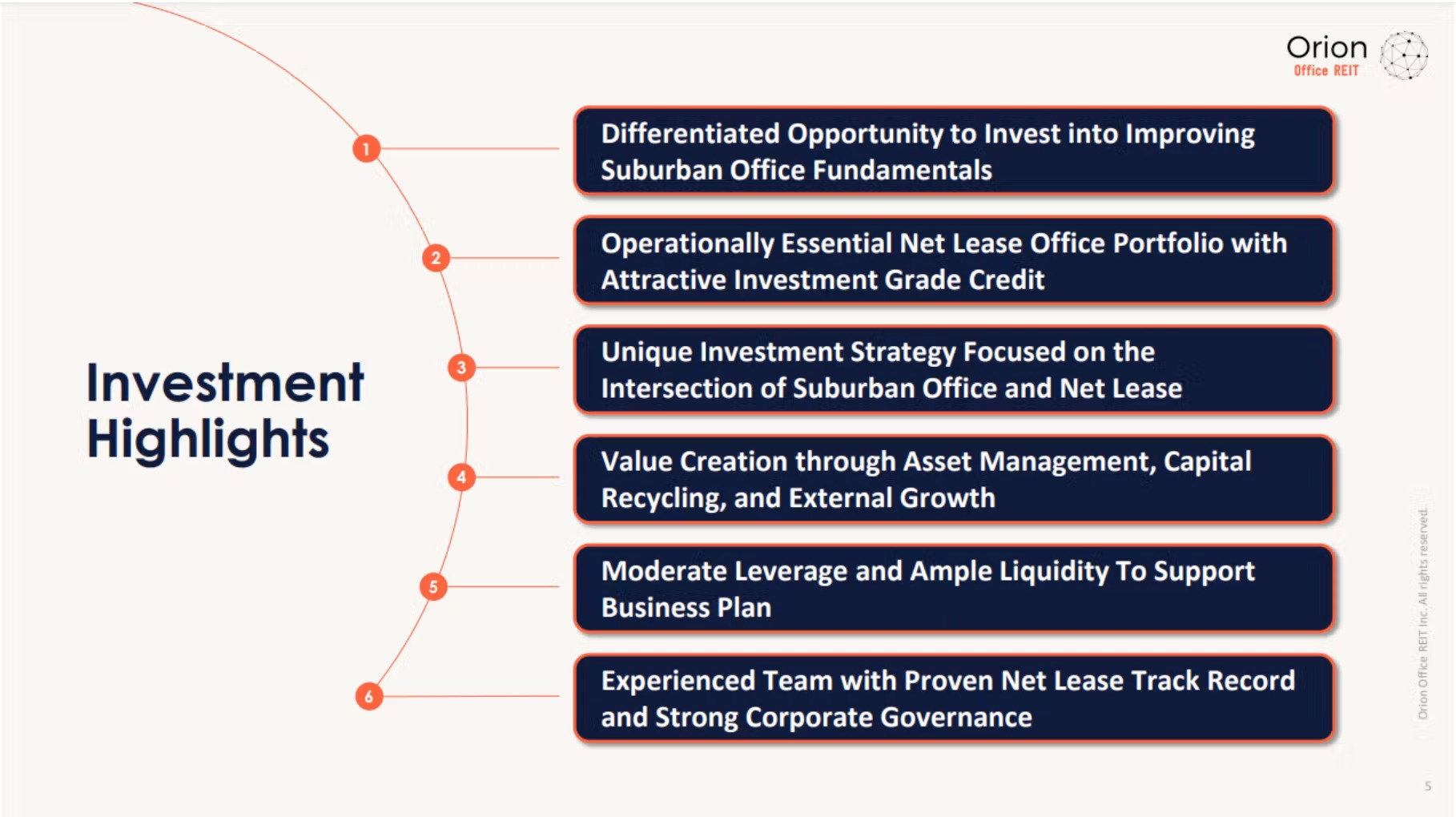

There's not much known about Orion Office REIT apart from investor presentation and historical SEC filings, from which we might conclude that FFO should be around $150-170 million so FFO per share around could be around $3-3.5.

Shares of Orion Office REIT plunged by 18% after the spin-off so it seems that investors are not buying into its story of unique suburban office scheme. They are more afraid of risks such as future of office space after the pandemic, 66% of rent expiration in next 4 years or higher concentration of 3 main industries.

Orion Office REIT has not declared the dividend yet but I can be a value plan, given the recent shares drop with an estimated Price-to-FFO ratio somewhere around 5-6 times. Dividend yield, once declared, can be appealing as well.

Nevertheless, no one should be surprised if investors just sold ONL shares to buy more Realty Income which offers more growth opportunities and proof of dividend history.

Source: Orion Office REIT investor presentation

Summary

Realty Income is a monthly dividend machine that made a bold step forward with VEREIT acquisition still during the pandemic.

While the market is not buying its office properties spin-off, Realty Income is a suitable company for dividend growth investors as it offers a high dividend yield and ambitious growth target and opportunities for years to come.

To see if Realty Income Corp will fit your portfolio, let's try our dividend calculator for FREE.

We're tracking and analyzing over 35 000 stocks and ETFs.

You can find great opportunities, calculate your perfect portfolio and keep track of your dividend stocks investments.

Disclaimer: This article is only for educational purposes. Don't buy or sell stock based solely on the above-mentioned information. Investment in securities carries risks.