Is Pfizer dividend stock interesting?

Pfizer and Moderna

The pharmaceutical giants Pfizer and Moderna, which were the first to develop vaccines against covid-19, will collect over $ 32 billion next year. That's according to estimates by investment banks Morgan Stanley and Goldman Sachs.

According to Wall Street analysts, both winners of the vaccine race will have record sales next year. Investment bank Morgan Stanley estimates that Pfizer will collect $ 19 billion next year, which it will share with German BioNTech.

Pfizer should collect about $ 9.3 billion in 2022 and 2023, Morgan Stanley analysts estimate. However, these changes don’t have much effect on the share prices of the pharmaceutical giant Pfizer with more than a 170-year tradition which only confirms the stability of this company.

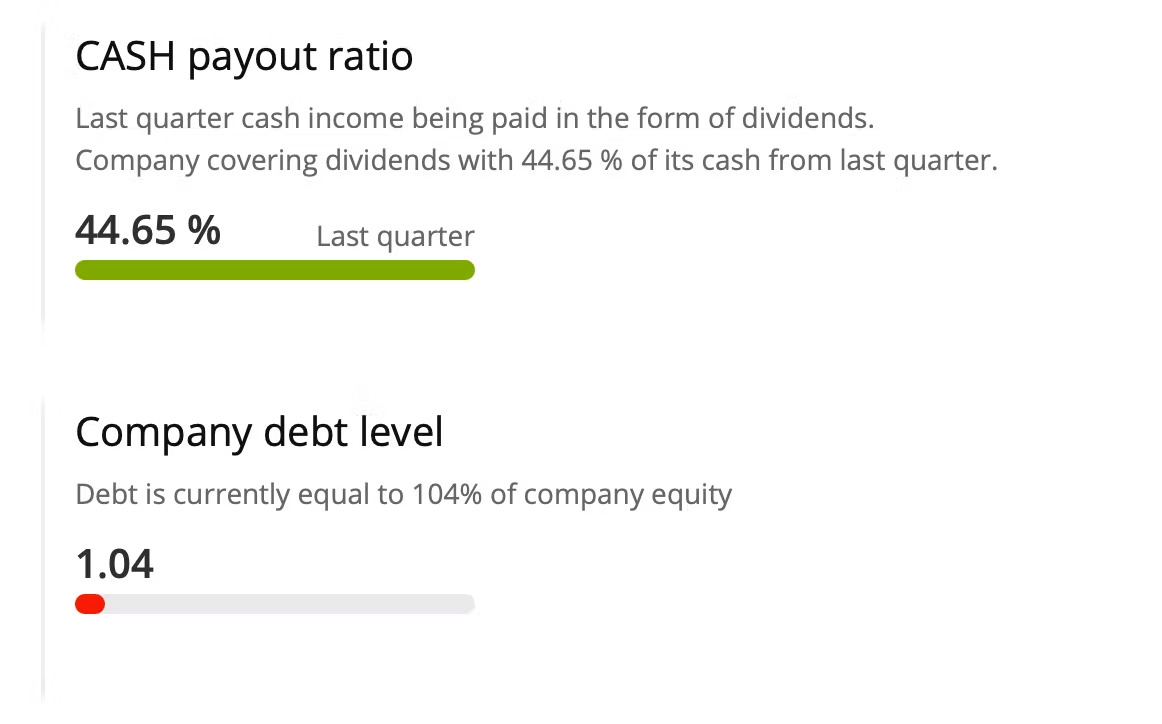

Pfizer pays quarterly dividends consecutively from the year 1980 making an impressive 40 dividend years track record. Pfizer also has a relatively stable debt level and a very positive CASH payout ratio just under 45% which can result in dividend yield growth or better dividend coverage by company expected income.

As a dividend investor, you should always look ahead of just current trends. The bottom line should be that Pfizer is a stable company with an interesting dividend yield and the Covid-19 vaccine is just a nice boost for a few years ahead for anyone considering to buy PFE shares.

TIP: Try our dividend calculator to simulate your potential investment in Pfizer.