Abbvie dividend safety analysis

Abbvie Inc is a biopharmaceutical firm and one of the most favored stocks for dividend growth investors. Today, we take a look at the details of its dividend safety using our new dividend safety rating tool.

About abbvie

The company researches and creates drugs primarily for the fields of immunology and oncology. It currently ranks fifth among the largest pharma companies in the world and third in the U.S. (by earnings).

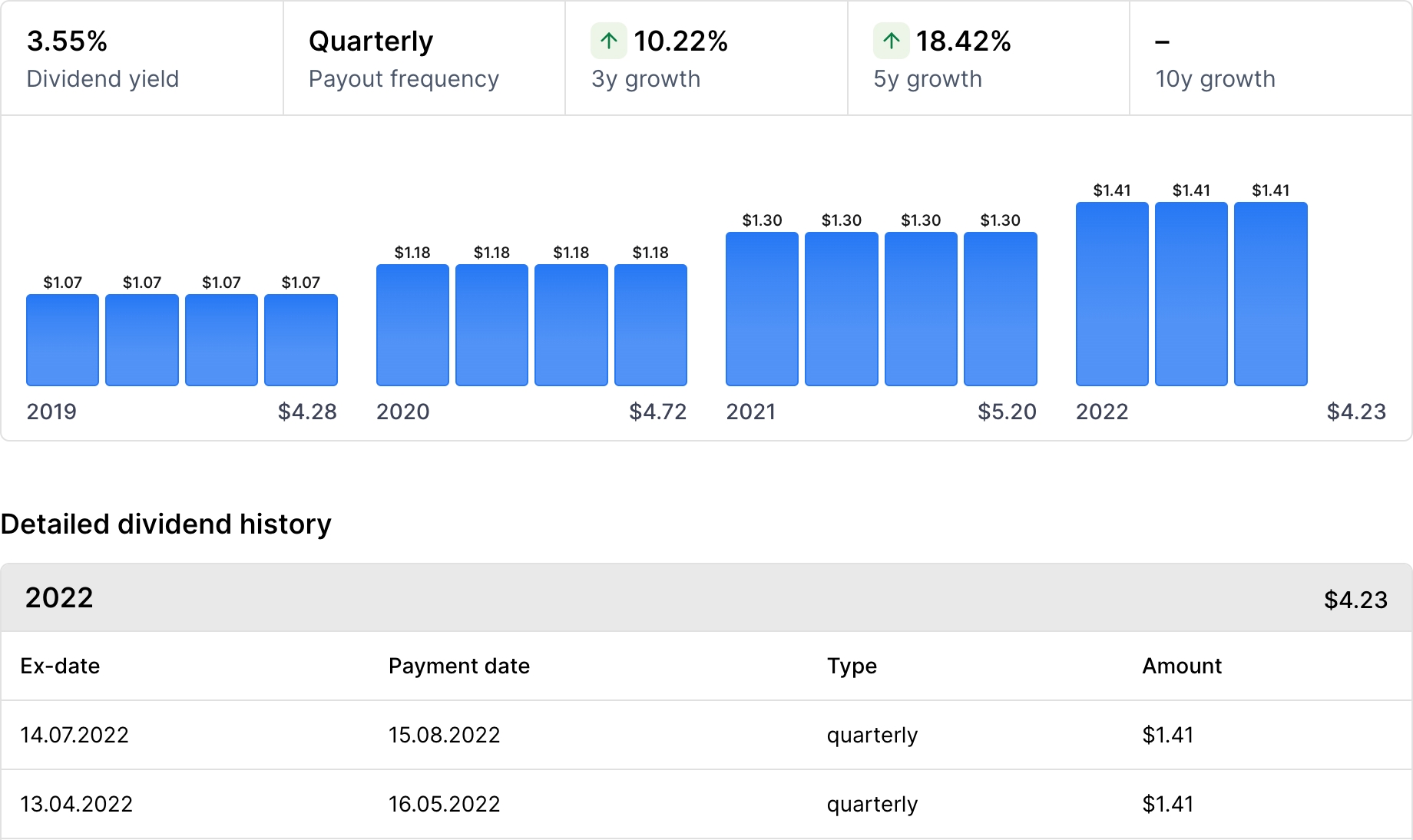

Abbvie Inc is only 9 years old but has a great track record. Over the past 5 years, its stock has risen 109.9% while paying a solid dividend. The current yield is 3.55%. You can explore its history on the dividend history page.

ABBV dividend safety

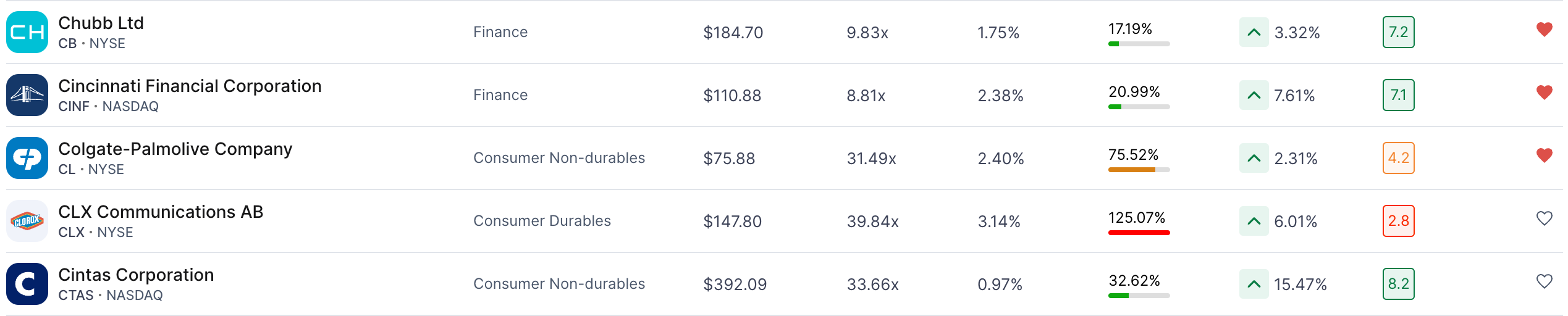

Now let's move beyond history and try to see if a nice dividend is also safe for the future. In the Safety Analysis section, we find two boxes that look at the ABBV ticker from 6 different angles and clearly show us the current situation and future outlook.

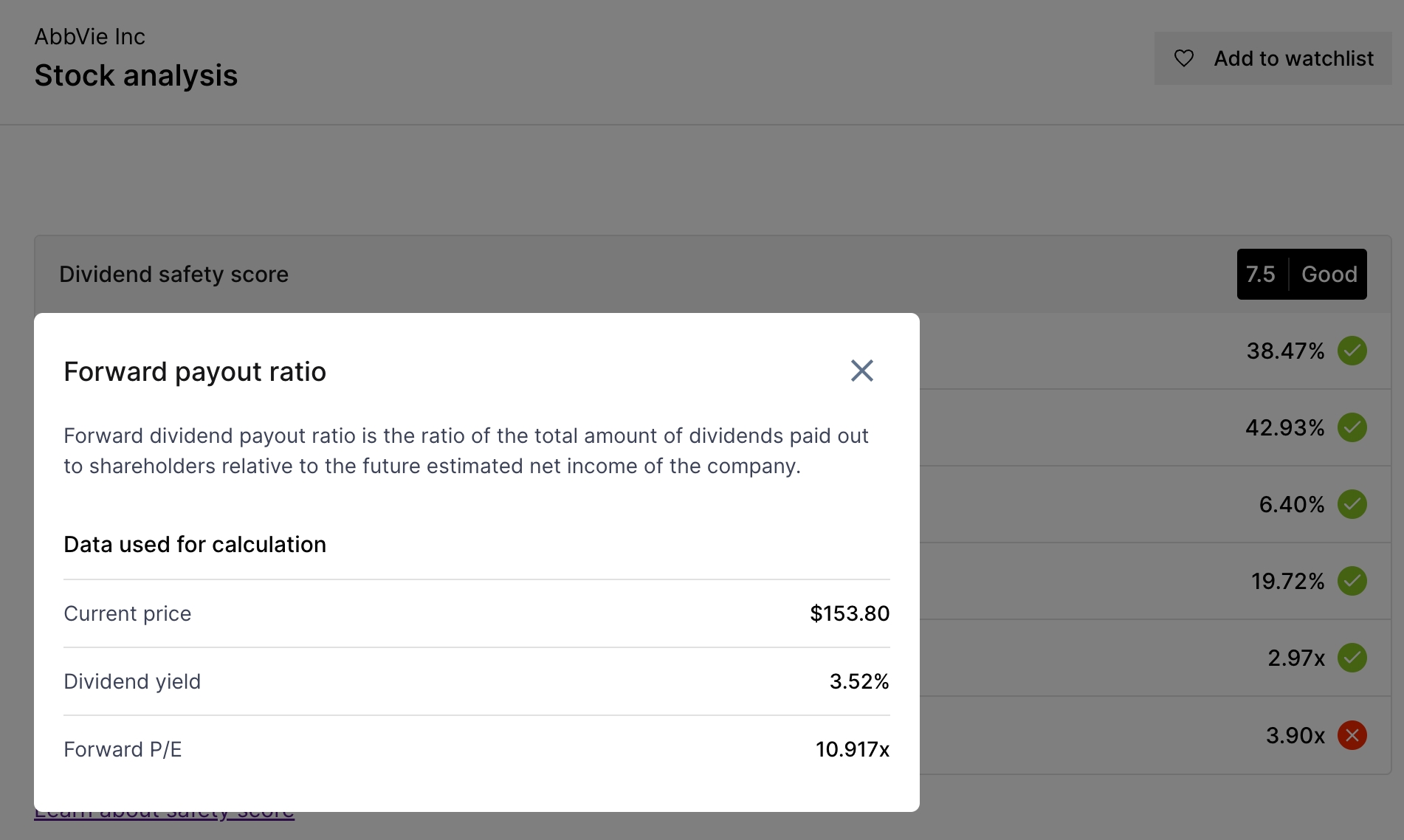

Forward payout ratio

One of the best indicators is the forward payout ratio, which for Abbvie is currently 38%. It's okay for companies with such a good dividend to have a ratio even around 70%, so there is still plenty of room for Abbvie after increasing dividends or investments.

How did this number come about? Just click on this indicator to find out the details. Analysts are currently projecting a forward P/E of 10.9 this is half the current P/E and indicates that analysts are expecting quite a bit of earnings growth going forward.

Payout ratio / Free cash flow

Next up is the Payout ratio / Free cash flow which is also at a very good level indicating good dividend health and more importantly good cash flow for the company. However, what we will be much more interested in now are the growth metrics....

Dividend growth and revenue growth

For these metrics we will look at the CAGR of dividend growth and earnings. The market is full of corporate tricks and accountants' magic. But one number never lies. Dividends – and especially dividend growth...

CAGR stands for compound annual growth rate. It simply tells us what is the average annual growth of dividends in the last 3 years. Here we see an average growth of 6.4% which is a good number for such a large company with such a healthy payout ratio.

We calculate revenue the same way. The average revenue growth over the last three years is 19.72% - a very good number. In comparison, Pfizer has averaged 14.86% growth (even with covid vaccines) and Abbot 12.10% (from which Abbvie was spun off).

Debt/EBITDA

With total debt of around 73.4 billion USD and EBITDA of around 24.7 billion USD the current ratio is 2.97x which is borderline acceptable due to company revenue growth.

Debt/equity

Equity is calculated by the company total assets minus its total liabilities. This currently equals 16.2 billion USD (you can check by clicking on the debt to equity label in our tool). With long-term debt, this makes the ratio 3.9x which our system and I assess as bad and something to look at more in-depth. That is why this value is marked in red.

Abbvie dividend safety score

You should never rely on metrics alone. They are just road signs navigating you towards interesting nubmers and facts about company you are about to invest in.

I will keep watching how they are handling the debt and if they manage to success in creating and patenting new pharmaceuticals.

Abbvie currently owns 1549 patents. Most famous one – Humira expiring around 2023 in US. Other patents (Botox, Skyrizi, Imbruvica) expiring around year 2030. New pharmaceuticals usually takes about 10 years to develop on average so it is also good to look at their development pipeline. We can find new medicaments emergning including new ones for Alzheimer’s disease and Parkinson's disease.

Abbvie development pipeline:

https://www.abbvie.com/our-science/pipeline.html

I’m long at Abbvie stocks and it currently generates quite big percent of my dividend income.

You can check Abbvie safety score here:

https://dividend.watch/screener/health-care/major-pharmaceuticals/abbv-nyse?scene=SAFETY_ANALYSIS

About dividend stock score

Dividend safety score is available with our premium plan. We are spending every day perfecting tools for dividend investors and our premium plan gives you unlimited access to our tracker, calculator and safety ratings.

Of course there's is 7-day free trial.

Disclaimer: This article is only for educational purpose. Don't buy or sell stock based solely on above mentioned information. Investment in securities carries risks. Just be smart and you will be okay.